skidoofast

Well-Known Member

- First Name

- Jeremy

- Joined

- May 8, 2025

- Threads

- 28

- Messages

- 227

- Reaction score

- 438

- Location

- Barnesville, MN

- Vehicles

- ford f 150, subaru outback

- Thread starter

- #1

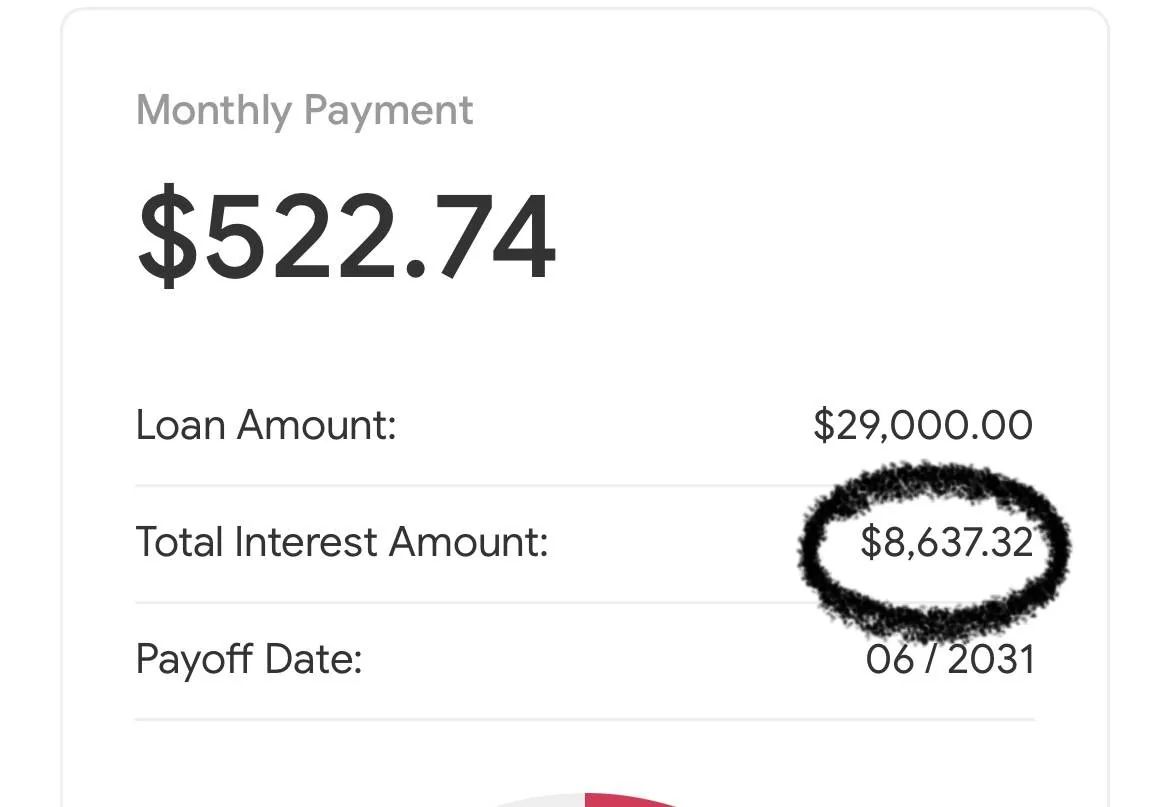

With EV tax incentives gone and everyone in an uproar about slates price in mid $20s

what if $0 down 0% for 72 months

here’s what interest would be at 9% if vehicle came in at $29k with extended battery

what if $0 down 0% for 72 months

here’s what interest would be at 9% if vehicle came in at $29k with extended battery